Why can’t you make more than what you can imagine?

Quick or slow, it’s a lifetime thing.

If you earn too slowly, you can’t even get your bills paid.

If you go too fast, you won’t have time to allocate it.

You use your time in exchange for money. In return, you get a secure job that you can work until they don’t want you anymore.

Many people are waking up to the fact that they aren’t going to make ends meet.

Because no matter how hard you work, labor will never outpace the speed the money you are working for is devaluing.

Everyone is struggling and losing to inflation, or not getting paid enough to keep up with their simple lifestyle of 1 house, 1 car, 1 wife, 1 kid, or two.

It wasn’t long ago, this was still achievable with one person working in the household. Now, you need someone with 2 or 3 jobs to stay where you are.

It’s all tension in people's faces whenever I see them alone.

What would you do if you could go back in time?

Back in 2017, right before the Crypto hype of BTC reached nearly $20K.

I was studying it along with gold and silver for about 2–3 years prior, while I ran my e-commerce business.

We were too afraid to invest anything, including ourselves.

I did have the power to make a difference, but I was too young, not in age but experience in the market.

Looking back today, there are at least 3 things I can invest in that would make me generational wealth, at least 5–10x my money.

I’ll tell you a little about it.

We were selling a fairly new cosmetics brand on the internet, where online retail arbitrage is at its prime, even as a latecomer then.

Dropping wasn’t even a thing back then.

People were selling stuff that was first available to be sold online.

You can imagine the sales volume if you find the right product.

No, you don’t even need to best product to win, the market was loose and you can sell anything to make bank.

It’s almost like today, where everyone is coming online to say something.

Over the years, things have changed, but one thing that remains the same is the opportunities for investing in something that grows.

What happens if I invest in what I was doing

I was mainly selling on Amazon under one main brand, the cash flow was great, and life was good. We don’t know how long this will last, but it did for a couple of years.

A good business that usually earns only takes a few good years to build and make decent money, and does not last very long to stabilize or lose traction.

250K the first year, if we take 10% out as an investment instead of holding inventory or reinvesting back into the business.

We often forget about longevity and use up the funds for the business or something else.

We were thinking about how much it should be each year; instead, we could have put that income elsewhere and let it grow.

The thing is, once we receive an income, we treat it like it belongs to us and sit on it until it starts losing value. The right thing to do is to put it to work for interest or appreciation.

What would it actually look like?

This will likely happen if we use the 25K to invest in any one of these investments.

From 2017 to today.

$25K in Amazon Stock, $38 to $220, =478% or 25K*4.78 = $119,500

$25K in this brand that went public while we are selling it. From $20 to 120 a share, = 500% or 25K*5 = $125K

$25K in Gold at $1,300 an ounce to 3,300, =153% or 25K*1.53 = $38,250

$25K in Silver at $17 an ounce $36, =111% or 25K*1.11 = $27,750

$25K in S&P 500 from $2,350 to 6,200, =163% or 25K*1.63 = $40,825

$25K in Bitcoin if bought at 10K, now 100K, =1000% or 25K*10 = 250K

Let’s list them out in the percentage gained.

Silver — 111%

Gold — 153%

S&P 500 — 163%

That cosmetics company — 478%

Amazon — 500%

Bitcoin — 1000%

Now, imagine I invest every year.

Most of them have wild swings in between and likely shake you off if you are just buying it to hope it goes up tomorrow or next week.

It took years for some of them to move, while others were hitting new highs each month.

You can only hold on to the money that your knowledge can understand.

There’s a saying called “you can’t earn the money that you don’t understand.”

Sure, there are people getting rich or making a killing every day, but you don’t know what they know, and that’s a problem.

You can even get lucky and hit a home run with microcap or some altcoins.

But you’ll likely return the money back into the market because you cannot earn what you did not know or understand over time.

We tend to do that a lot naturally because we believe that we do it ourselves can make a difference.

What does it mean to build to have generational wealth?

You have a strong financial foundation with no high-interest debt.

With an emergency fund that is saved up for a rainy day or events that stop you from earning from your 9–5 job.

These are the very basics. Next, you would like to increase your income.

It usually requires a long-term asset that doesn’t disappear or lose value over time to inflation or counterparty risk.

This is when you need to have diversified cash flow and assets.

Many would choose real estate, yet in recent years, interest in mortgages is sky high, like 200% higher than it used to be when interest rates were low.

That’s why digital products are likely to do well in the coming years.

Everything is going up in price

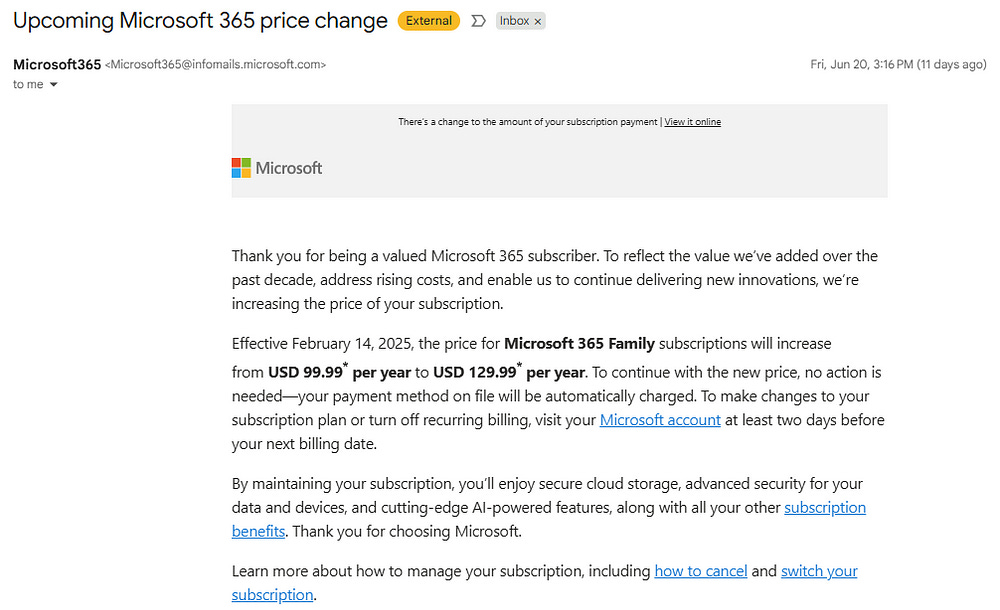

Even Microsoft is increasing its price by 30%, did it really get that much better? Or an additional feature that is worth the new price?

We can say, probably not.

This is a price hike they did earlier in the year, as mine, or I should say the company’s account, is ready for renewal. Good thing now we have a corporate account.

If you can create a software or a simple digital product that people can use, then you’re way ahead of the game, as the cost is not that much for something that is highly scalable.

Within this realm of there a many to choose from for longer-term growth.

Just to name a few:

Ebooks

Online Courses

Notion Templates

Newsletter Subscription

Voiceovers or Audiobooks

1-on-1 Coaching

There are so many more to choose from, or you can create something customizable for what you want to provide value in.

They each can scale up differently, but over time, you’ll find which one fits you the most in terms of value proposition and time allocation to task.

For me, writing is a way of learning something new, while I may not be doing the thing, but knowing it is the first step.

When you know all the common sense of an expert, your ability to absorb useful information about what you want to do will increase manyfold.

Thanks for Reading

Disclaimer: This article is for educational and entertainment purposes only, not financial advice. All investment has risk; if you don’t know what you are doing, consult a financial advisor as needed.

This story was originally published on [Medium] and is cross-posted here for a wider audience.

Supporting me can change your life because you are changing mine.

Feel free to support me with a like.

Your support is always appreciated.